Monzo has unveiled new app-based features to help prevent criminals from raiding people’s savings after stealing their mobile phone.

The digital bank said the security control tools were the first of their kind to be launched across mobile banking.

The features have been designed to prevent criminals transferring or withdrawing money from customers’ accounts, either as a result of phone theft, impersonation scams, or stealing personal information.

Customers will be able to opt in on their apps when the tools are rolled out in the coming weeks.

It comes amid a rise in incidents of phone theft over recent years with particularly high levels reported in London.

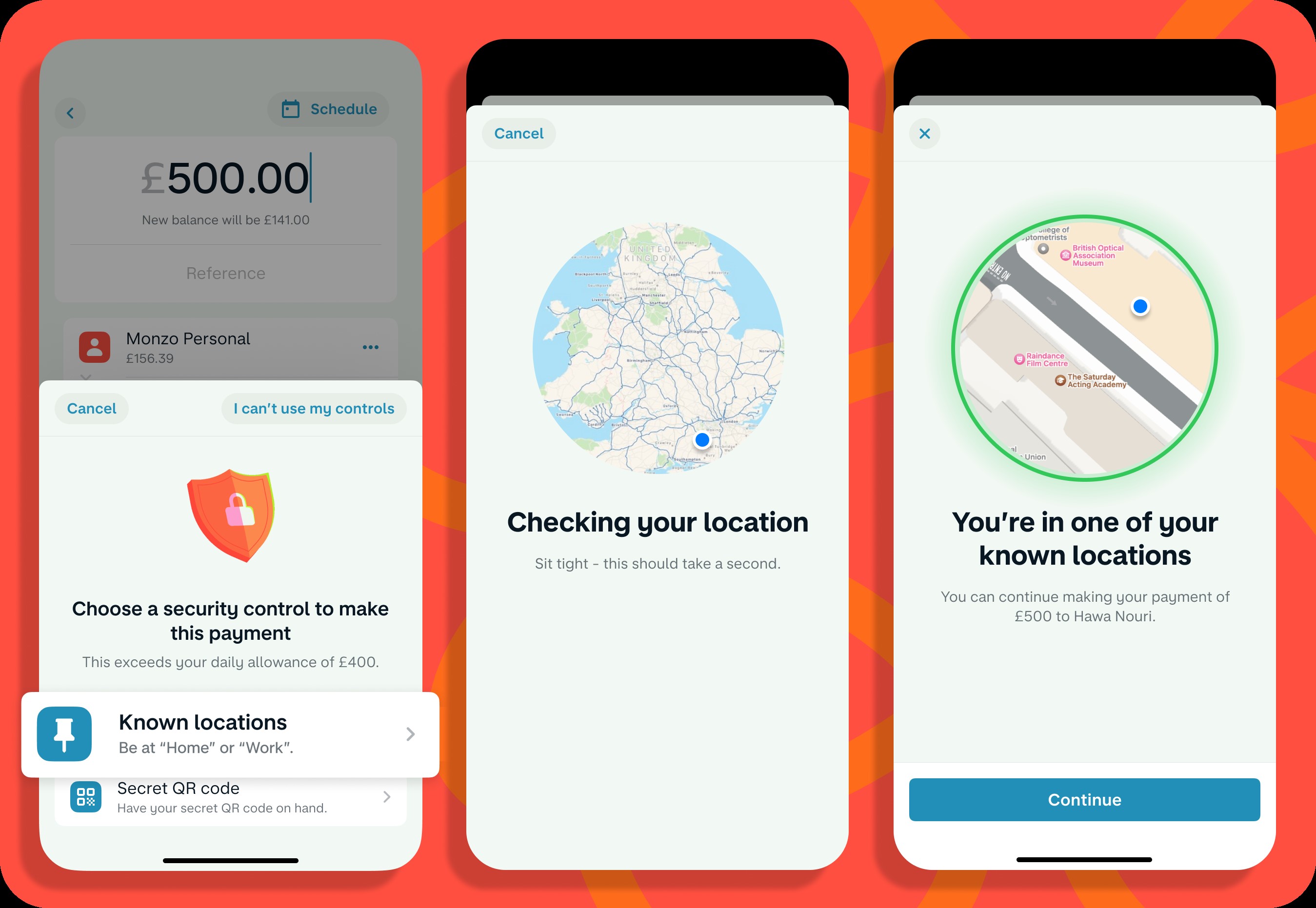

Monzo’s new “known locations” feature will give customers the option to choose a location, like their home or workplace, that they need to be in when transferring money or withdrawing savings over a certain limit.

Using tracker technology, the bank will identify if their phone is not in one of the chosen locations and block any attempted transactions.

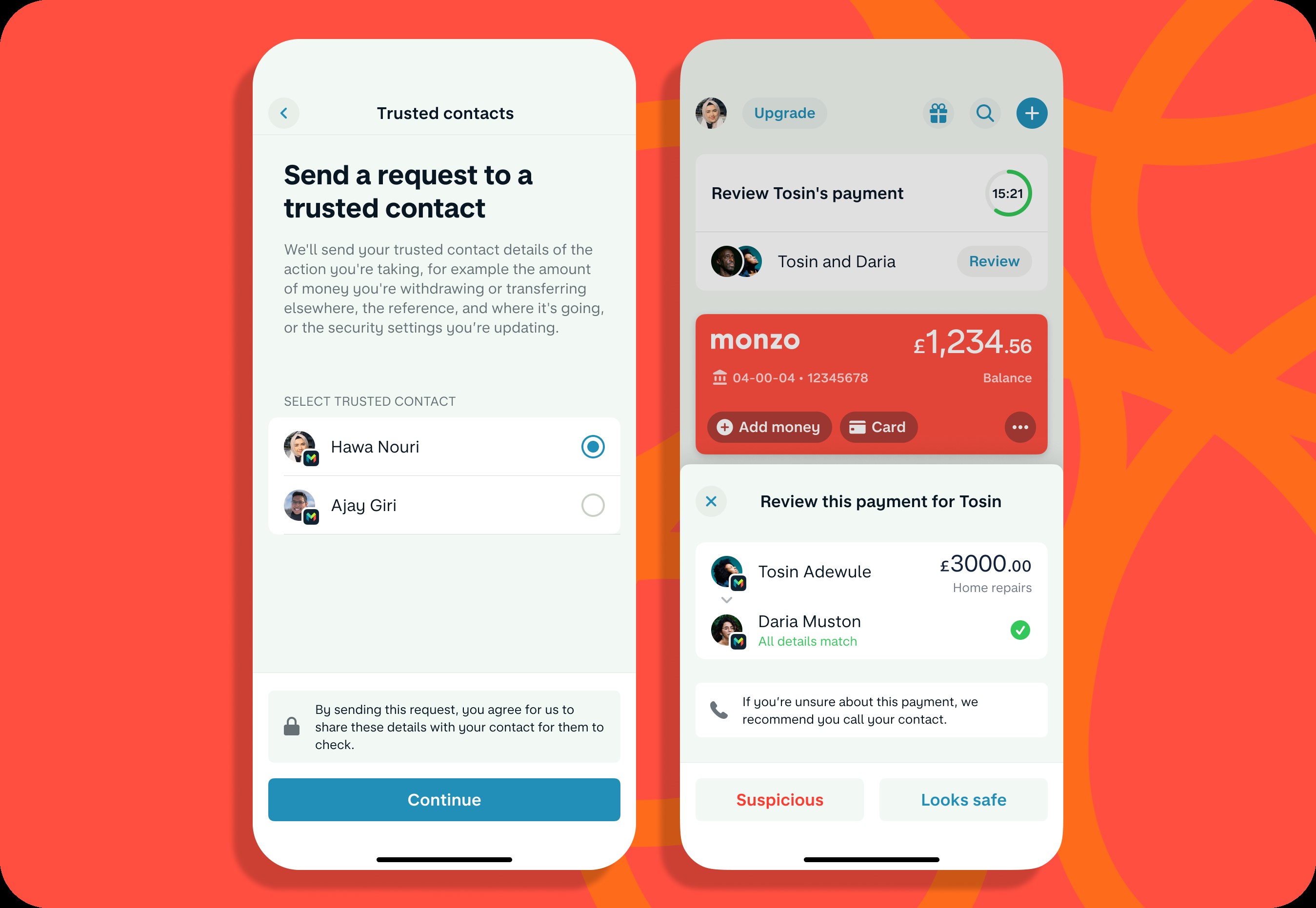

Customers can also choose to invite a trusted friend or family member, who also has a Monzo account, to be notified before they send or withdraw money over a chosen limit.

That person can then review whether they think the payment looks safe or is suspicious.

Priyesh Patel, a senior engineer at Monzo, said the bank was trying to “outpace” the tactics of fraudsters by rolling out new in-app tools.

He said: “Whether it’s choosing your safety radius with known locations or having a trusted contact sense-check your payments before you make them, these features offer customers peace of mind and force a much-needed moment of pause in a high-stakes situation.”

The bank, which has about nine million customers, also unveiled a third new feature whereby customers can choose to authenticate a payment by getting a “secret” QR code sent to a different device.

They then have to scan the code through their Monzo app for the transaction to go through.

Mr Patel said there was “much more to come” after launching the three new security controls, which customers have to opt in to using.

About 90,000 mobile phones, or 250 a day, were stolen in London in 2022, according to the latest statistics from the Met Police.

A separate survey, last month, from money insights provider Intuit Credit Karma found that around a 10th of people in the UK say they have been targeted by thieves for their phones in the past five years.

Meanwhile, the level of fraud has been spiralling across the country, with banks taking steps to try and prevent people losing their savings to scammers.

Trade body UK Finance found that more than £1 billion was stolen by criminals through unauthorised and authorised fraud last year.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here